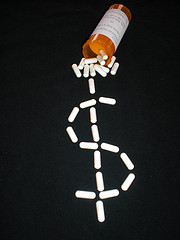

We pride ourselves on our work helping whistleblowers bring claims pursuant to the False Claims Act. As a False Claims Act law firm, we have specialized knowledge of this complex piece of legislation that empowers individuals to bring fraud claims on behalf of the government. A ruling from a federal district court released in late Spring in a case alleging Medicare fraud looks at one of the many important details that come up in these cases. More specifically, the case looks at what constitutes a “usual and customary” price for purposes of determining whether a provider is complying with the law and offering Medicare beneficiaries an appropriate price on prescription drugs. In doing so, the court highlights one important requirement that is often subverted by perpetrators of fraud and also provides a reminder of how complex False Claims Act cases can be.

On May 27, 2006, the Seventh Circuit Court of Appeals released an important ruling in United States ex rel. Garbe v. Kmart Corporation, a False Claims Act case brought by James Garbe on behalf of the United States against Kmart. According to the complaint, Garbe, a pharmacist at Kmart, noticed that another pharmacy charged his Medicare Part D insurer substantially less that Kmart typically charged insurers for the same prescription. He investigated and found that Kmart routinely charged customers paying out of pocket less than it charged those paying with insurance (public or private). He also found that most cash customers took part in Kmart’s “discount programs” and that this discount price was not included when Kmart calculated its “usual and customary” prices on generic medications for purposes of Medicare reimbursement.

Healthcare Fraud Lawyer Blog

Healthcare Fraud Lawyer Blog